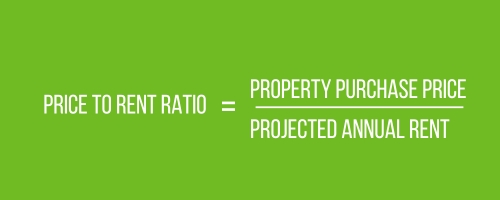

Price-to-rent ratio is a quick and simple metric used by real estate investors to evaluate potential investment opportunities. It’s a tool that helps gauge a rental property’s potential for both near-term profitability and long-term viability.

The equation is simple: divide a property’s purchase price by the annual rent it can generate.

But getting smart about this equation? That’s a bit more involved.

What Is a Good Price-to-Rent Ratio?

When investing in rental property, a top priority is often cash flow. And the right price-to-rent ratio can help you achieve a strong cash-on-cash return, meaning a steady stream of cash that you can use to increase your capital for future investments.

Cash-on-cash return is the money earned on actual cash invested into a piece of real estate.

For example, if you put down $10,00 for a property, and after expenses, your net gain for the year is $1,000 back in your pocket, you earned a 10% cash-on-cash return.

Parlay positive cash flow into additional investments (with excellent price-to-rent ratios), rinse, repeat.

Sounds easy! But watch out for the pitfalls:

The Game Changes

In the world of real-estate investment, it’s important to stay on your toes and tuned into the realities of now. Let’s take the 2% rule as an example:

Years ago, property owners looked for properties that could fall within the 2% rule—meaning you could charge 2% of a property’s purchase price in monthly rent. So if you bought a home for $100,000, you’d aim to charge $2000 a month in rent.

Those were the days!

In today’s market, the 2% rule is almost impossible to hit. Investors have lowered it to 1%, which certainly lowers the cash-on-cash return, but still makes for a strong investment.

The market will always fluctuate. Don’t assume that what worked in the past will work now. Make sure your means of assessing properties are current and valid for today’s market. And don’t let yourself get fooled by emotion. Which brings us to…

Potential Rent vs. Actual Rent: There’s a Difference

Real estate agent ≠ investment expert.

Many real-estate agents have a habit of discussing market rent with clients when that is decidedly not their area of expertise. And many investors have a habit of listening to them.

Most frequently, we see this play out in 1 of 2 ways:

- Real estate agent suggests a property’s rental rate based on market comps—when the property is not, in fact, on par with those comps, and would require significant work (read: money) to get there

- Real estate agent suggests that the rental rates should be higher than true market rent due to an outlier comp and/or limited scope of research

If your real estate agent is getting you excited about a property’s potential, take a pause. Big wins don’t come from exciting conversations; they come from getting real.

Analyzing Multi-Family Deals

When it comes to multi-family, there is a fairly easy solution: analyze every deal by looking at what the property is actually generating right now.

If a property isn’t renting for market value, there’s a reason. #SorryNotSorry

Maybe:

- The units are dated

- The location is undesirable

- There are issues with the unit sizes

- There are problems on the leasing side

The best way to get emotion out of the picture and get smart is to look at what the property has actually yielded.

Analyzing Single-Family Deals

Single family can be a little more difficult, as often, an investor is purchasing a vacant property. However, many homes have incredibly similar (or even identical) comps in the same market.

The key is not fooling yourself by assuming you will get top-of-market rent. Be honest about the condition of your target property, and be conservative in your market rent estimates.

And remember: while understanding a home’s price-to-rent ratio is key to landing great deals, smart investors never sacrifice location or quality just to save a little money upfront.

Which brings us to…

Buying In Economically Depressed Areas

When investors get good at understanding metrics and strategies like price-to-rent ratio, they can become tempted to look toward areas where home prices are incredibly low.

The numbers might seem to make sense on paper, but in reality, they often fall apart.

In extremely economically challenged areas, keep your tenant base in mind. If you have to evict a tenant every few months, have rent go unpaid, or turnover a unit prematurely, it is impossible to hit your cash flow projections. Crime rates and ongoing repair and maintenance costs are factors to consider as well.

The key is to find a quality area where purchase prices are not unfeasibly high, and rents are relatively strong. 1% per month is a reasonable ballpark to start from. If you drive the area and see the yards maintained, well-kept cars in the driveways, activity in restaurants and stores, etc., you may have found a good potential location for an investment property.

In short, you get what you pay for. Just because a low purchase price makes the numbers work well on paper, it is not necessarily a good investment. Which brings us to…

A Door Is a Door Is a Door

We see this all the time: An owner is looking for the most budget-friendly way to get profitable on a small, multi-unit building with low rents. And instead, in no time at all, the expenses eat him up, because there’s not enough income to offset them.

What’s really going on here? The answer isn’t talked about enough in the investment world:

A unit that brings in $500 a month can have the exact same number of doors, cabinets, and microwaves—and the same size roof—as a unit that brings $1200 a month. In other words, the expenses aren’t that different, but the income really is.

Many of the expenses associated with owning rentals are basically fixed from one investment to the next. So go for the higher rent potential (i.e., actual rent potential…see above). It’s a simple bit of secret sauce for getting you the price-to-rent ratio you need.

Smarter Investing: Getting Real with Price-to-Rent Ratios

In the early 2000s, one of the most popular tools for determining price-to-rent ratio was Craigslist. But investors had to browse each individual ad to get an idea of what homes were selling and renting for in a certain area.

Now, investors can use Zillow, Realtor.com, and other apps to quickly compare properties and see mapped home prices for an entire area with a few clicks. That’s a great opportunity for assessing price-to-rent ratios quickly and making smart location choices. (May we recommend Downriver?)

In other words: do your homework; choose quality properties; and partner with a property-management team that can help you care for your tenants with excellence and efficiency.

Pass It On: Understanding Price-to-Rent Ratios and More

Know someone who would benefit from learning more about price-to-rent ratios or our property-management tips? Please share a link to this post or encourage them to subscribe.